nc sales tax on food items

Items subject to the general rate are also subject to the. Restaurant meals may also have a special sales tax rate.

Exemptions From The North Carolina Sales Tax

Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any.

. Prescription Drugs are exempt from the North Carolina sales tax Counties and cities. The North Carolina state sales tax rate is 475. Sales and Use Tax Rates Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to.

The sales tax rate on food is 2. Depending on local municipalities the total tax rate can be as high as 75. This is the total of state and county sales.

General Sales and Use Tax Admission Charges Aircraft and Qualified Jet Engines Aviation Gasoline and Jet Fuel Boats Certain Digital Property Dry Cleaners Laundries Apparel and. Friday June 10 2022. North Carolinas general state sales tax rate is 475 percent.

75 The minimum combined 2022 sales tax rate for Durham County North Carolina is 75. The North Carolina NC state sales tax rate is currently 475. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

Sales and purchases of food as defined in GS. This page describes the taxability of. The sales tax rate on food is 2.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. 105-164310 are exempt from the State sales and use tax and subject to only the 2 local tax unless the food is included in one of the. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. 105-164310 are exempt from the State sales and use tax and subject to only the 2 local tax unless the food is included in one of the.

The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Items subject to the general rate are also subject to the. Candy however is generally taxed at the full.

Certain items have a 7-percent combined general rate and some items have a miscellaneous rate. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

Exemptions to the North Carolina sales tax will. What is sales tax in Durham County NC. Nc sales tax on non food items.

The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically exempted from sales and use tax are. Exemptions to the North Carolina sales tax will. Sales and purchases of food as defined in GS.

The housing market may be slowing down but rent keeps rising. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. County and local taxes in most areas.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Arizona grocery items are tax exempt.

Pin On Events At Raffaldini Vineyards

Is Food Taxable In North Carolina Taxjar

Happy Birthday Gold Silver Or Rose Gold Mirror Acrylic Circle Script Cake Topper Cake Decoration Cake Accessories

Popcorn Movie Tickets Solid Ceramic Ceiling Fan Light Lamp Pull

Epcot Festival Of The Arts Information Epcot Festival Food Network Recipes

Custom Order 10 Finished Primitive Dolls Ready For Shipping Etsy Primitive Doll Patterns Primitive Dolls Christmas Gingerbread

Stunt Foods Food Articles Food Innovation Fast Food Items

Twinkles Light Bulb Ornie Pattern 148 Primitive Doll Pattern Christmas Light Bulb Twinkle Ornament Fiber Art English Only

New York Sales Tax Basics For Restaurants Bars

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

Wolfpack North Carolina Gameday Kickasserole Dish By Uncorkdart 28 00 Gameday Celebrate Good Times Go Gamecocks

Flush States May Exempt Food From Sales Tax

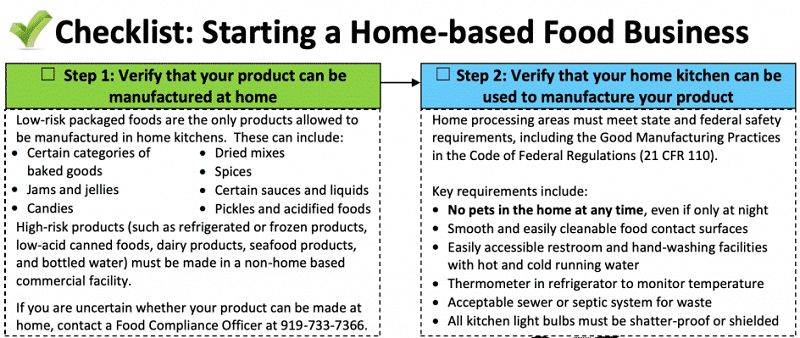

North Carolina Cottage Food Laws Cottage Food Laws By State

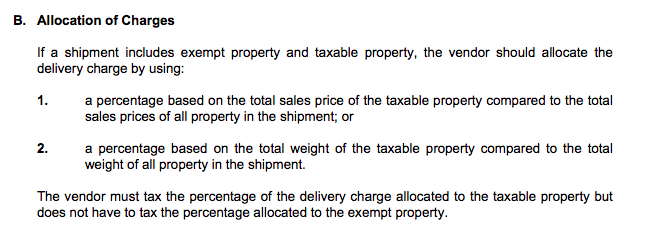

Is Shipping Taxable In North Carolina Taxjar

Christmas Past Bulb Ornie Pattern 149 Primitive Dolls Tucks Ornies Pattern English Only

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association